Jun 10

2020

Fraud Detection with Machine Learning For e-Commerce and Retailers

There is interesting research in Forbes’ recent article named “How E-Commerce’s Explosive Growth Is Attracting Fraud”. According to the statistics, e-commerce retail sales achieve 209% year-over-year revenue growth. It is expected that this indicator will grow, which means it will seduce fraudsters even more. This is a completely obvious pattern – big money always means a lot of attraction for attackers.

Is there a way to protect your business from these risks? We are sure there are. In this article, we will tell you how eCommerce fraud prevention and detection system work being powered by machine learning and artificial intelligence.

What Is Fraud in e-Commerce?

E-commerce and retail fraud mean any activity aimed at deceiving sellers or buyers in order to seize goods or money. In the e-commerce industry, all fraudulent transactions occur online. As for retail, fraud at the physical point of sale of goods is also possible. AI and ML solutions to encode expertise for detecting fraud in eCommerce and retail can handle both tasks.

What Are the Three Types of Fraud?

In fact, it is possible to identify more types of fraud depending on the nature of the crime, the level of damage, tools for committing fraud, and even unrealized criminal plans. Basically, it is possible to distinguish three main types of fraud.

Mobile Fraud

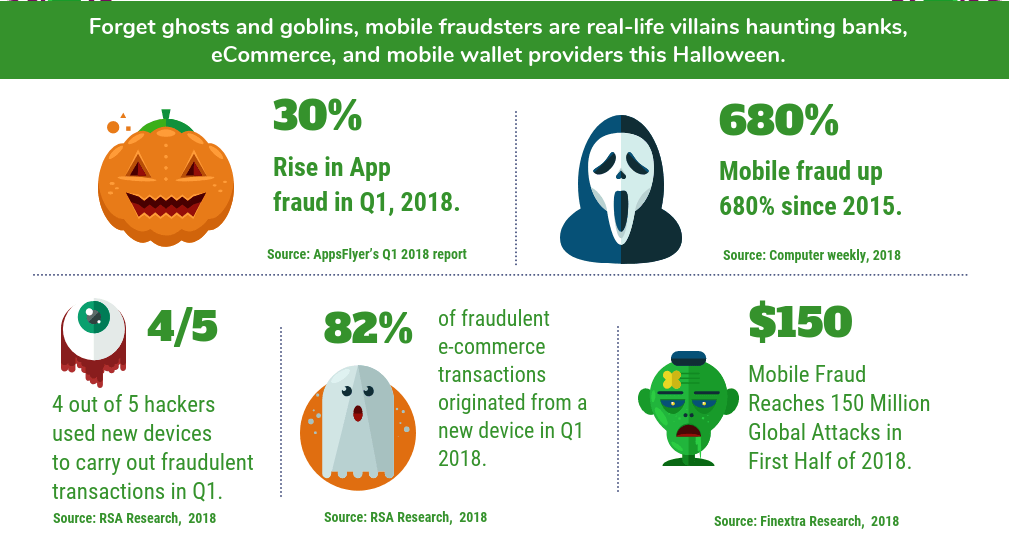

This is a fairly logical phenomenon – the more users began to use mobile phones for instant transactions, the more scammers thought that these devices might have hidden potential. The infographic below illustrates the current situation with mobile fraud.

Moreover, this is the case when businesses and individuals are equally at risk. Very often, mobile fraud becomes a way of illegally making purchases on behalf of another person.

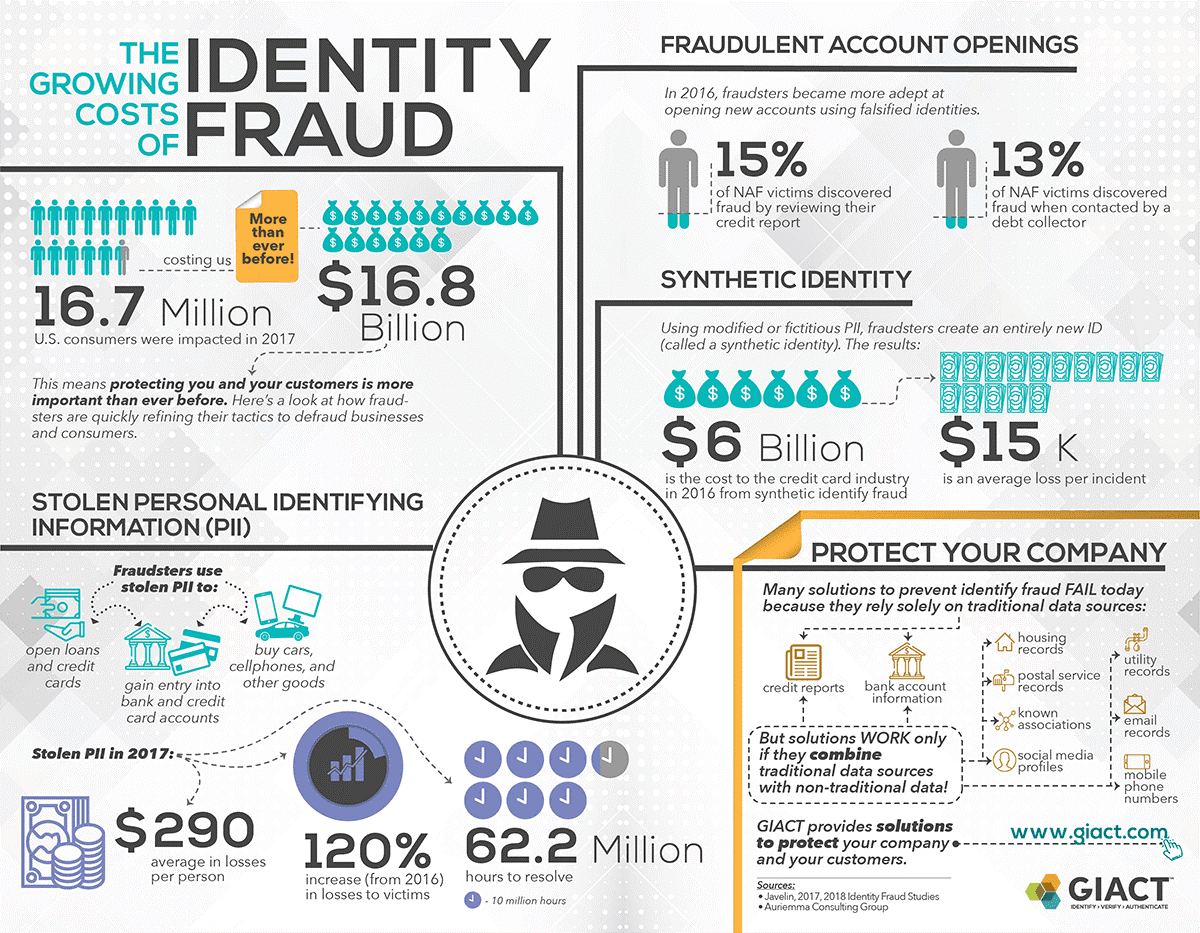

Identity Theft

Identity Theft is the second type of fraud that is very popular. Who do you think are the most frequent victims of this type of fraud? These are Millennials, the most active users of social networks and the most solvent category of the population at the same time.

The thing is that social networks allow you to make a portrait of a person and collect all the necessary data very easily. It’s not even necessary to hack anything. And comprehensive personal data also easily provides access to e-mail, and other applications, including financial ones.

Friendly Fraud

Friendly fraud or chargeback fraud is the situation when a loyal customer is a fraudster. Moreover, in this case, the third party – the bank that issued the card is involved in the process, not even suspecting that this is a fraud. The essence of this scheme is that an allegedly law-abiding buyer makes a purchase in an online store, pays the entire amount, and after a while calls the bank and claims that he did not receive the parcel, or that he canceled the order, but did not receive the money back.

In this case, both the retailer and the bank should be warned about the possibility of fraud. Fraud prevention with ML in eCommerce will be useful, and what is more, there is also a solution developed by SPD Group for the financial/banking sphere.

Here is how eCommerce fraud detection solutions work in practice.

How Does Fraud Detection Software Work for e-commerce Fraud Prevention and Detection?

According to the research, “Detection software can help in the process of fraud prevention, by warning them of the appearance of certain warning signs, so-called “red flags”, that indicate the possibility of fraud or some illogical that can either be the result of errors or manipulation.” Here is how this process occurs on practice.

- Tracks behavior. ML fraud detection systems are powered by data. At the moment of creation, they get knowledge about the patterns of behavior that are typical for each user. So the system will consider the transaction to be legal if the actions of the customer fit into its knowledge about his usual behavior.

- Catches anomalies. Following this logic, smart ML algorithms are able to catch anomalies and send an alarm if something goes wrong. What is more, advanced systems are able to self-educate and take into account all the previous precedents.

- Uses real-time data. Compared to old, rule-based systems, ML solutions are operation here and now, taking into account every action that occurs in real-time. That is why the decisions of whether a certain action is legal or not are also made instantly.

What types of fraud cases can be dealt with eCommerce fraud prevention tools?

So, here are the main fraudulent cases that ML fraud detection and prevention systems are able to catch.

eCommerce

- Account takeover. This is one of the most popular fraudulent scenarios, and as we have already said, it is possible to find out if the account was taken over by analyzing behavior patterns.

- Affiliate fraud. In this case, the systems track the behavior of affiliates in order to find out illegal attempts to get commissions from an affiliate marketing program.

- Proxy server fraud. This is a familiar case for international e-commerce stores when fraudsters use proxy servers to make an impression of different IP addresses. An ML tool will easily detect this idea.

Retail

- Credit card fraud. Credit card fraud is the reason for the most financial losses – for banks and customers as well. The only thing to prevent it is to use ML systems on both sides – in the retail store and in the bank.

- Card-not-present fraud

- RTO and promo code abuse. This is one more type of friendly fraud, and by analogy with proxy server fraud, ML systems are able to find out when there is a fraudulent attempt.

- Triangulation fraud. In simple words, this is a resale of goods obtained fraudulently. It is quite difficult to track this scheme because it looks too believable, however, with enough data, the machine learning system will cope with this task as well.

Main Risks of e-Commerce Fraud Detection Tools Save You Business From

Basically, it is possible to highlight the three main risks to which you expose your business if you do not use fraud protection systems. Which one is the most frightening for you? Most likely, you will answer that each of them represents a separate threat to the business, and you will be right.

| Financial losses | Data breaches | Reputation damages |

| According to the study, it is estimated that by 2021 owners of eCommerce and retail businesses will lose $6.4 billion due to fraud. Is it a lot or a little? This is more than enough to start taking action. | On average, one data breach cost American company $8,19 million. Maybe, you will be pleased to find out the cost of a data breach is the lowest for retail, but keep in mind that every data breach means reputation damage too. | Reputation damage can’t be measured with the help of money or other mathematical indicators. And this is almost the only thing that can’t be restored. A large part of your disappointed customers will never trust you again. |

How Much Does It Cost to Implement an ML Fraud Detection Solution?

In fact, it costs no more than possible losses from risks that you can avoid. What is more, ML and AI technologies are becoming more and more affordable each year. If earlier only huge corporations may afford to pay a lot of money to get a fraud prevention solution based on ML, then now the price is quite adequate for medium-sized businesses.

On average, eCommerce fraud prevention tools cost from $100,000.

Conclusion: What is the best approach to implement eCommerce fraud solutions

The best approach to implement an eCommerce fraud detection tool is to start with the type of fraud that worries you most. But even if you have never faced fraud in your store, this is not the reason to stay unprotected. In both cases, the main thing to do is to get in touch with a reliable vendor, decide on your main problem, and together create a custom ML fraud detection solution for your business.