Jan 5

2018

2018 Will Be the Year of Hypercompetition and Disruption In Healthcare Tech

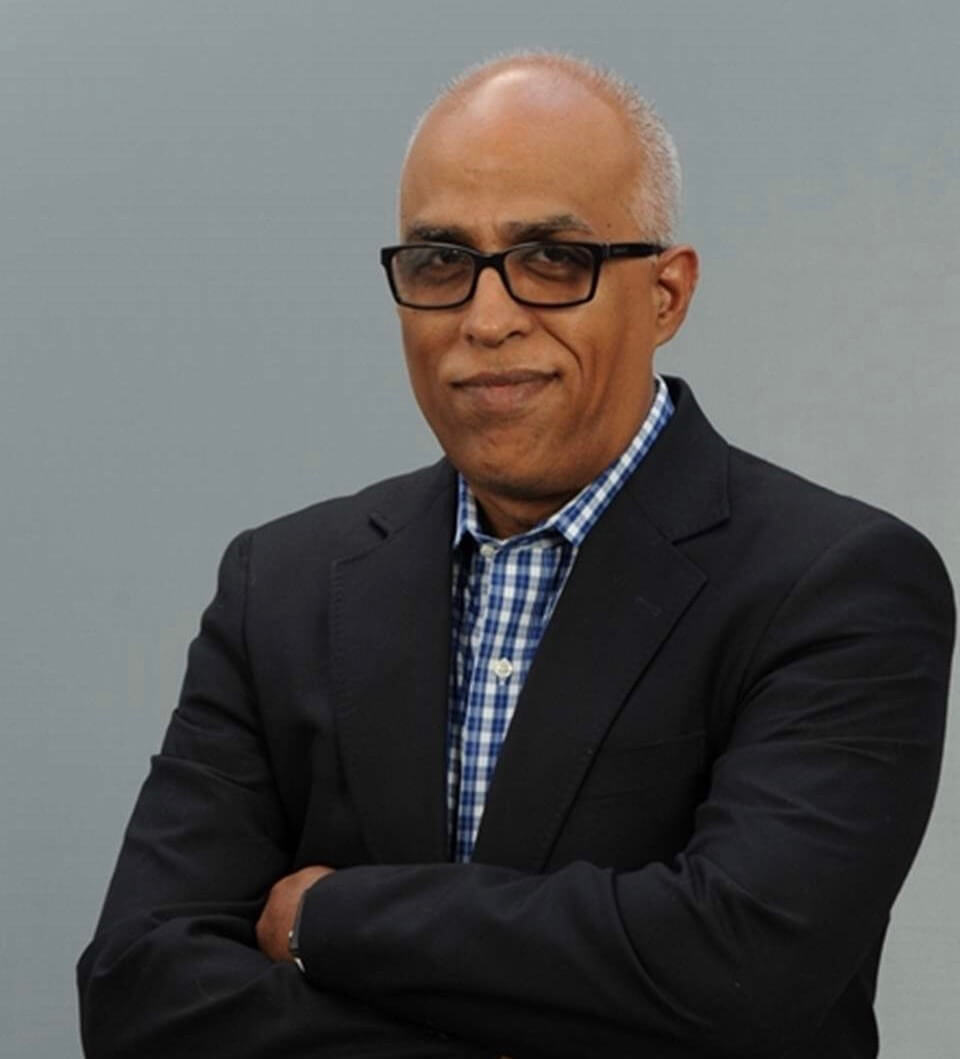

Paddy Padmanabhan is the author of The Big Unlock: Harnessing Data and Growing Digital Health Businesses in a Value-Based Care Era and is CEO of Damo Consulting Inc.

The digitization of healthcare records across the nation over the past several years has created an electronic backbone for patient data that is in the early stages of getting unlocked for value. However, as we have seen in the past couple of years, technology-led change is slow to take hold in healthcare, and the policy uncertainty of the previous year has meant that healthcare enterprises have been cautious with technology investments.

In my latest book “The Big Unlock,” I discuss the competitive forces within the healthcare technology provider landscape, which I have classified into four major categories: The custodians are the dominant electronic health record (EHR) vendors who have the data and the workflow. The enablers have built platforms that they hope will be used by the enterprises as well as other technology providers to develop new digital health experiences. The arbitrageurs are solutions and services firms that rely on global labor pools, and increased automation, to deliver technology-enabled services at lower costs. The innovators are developing new ways to provide healthcare experiences, and are often venture capital funded startups.

In my latest book “The Big Unlock,” I discuss the competitive forces within the healthcare technology provider landscape, which I have classified into four major categories: The custodians are the dominant electronic health record (EHR) vendors who have the data and the workflow. The enablers have built platforms that they hope will be used by the enterprises as well as other technology providers to develop new digital health experiences. The arbitrageurs are solutions and services firms that rely on global labor pools, and increased automation, to deliver technology-enabled services at lower costs. The innovators are developing new ways to provide healthcare experiences, and are often venture capital funded startups.

These categories are not watertight compartments, but indicate a dominant business model for a particular type of solution provider. Vendors in each of these groups face challenges related to organic growth within their space and competitive pressures from other incumbents as well as new entrants. In response, technology providers in a specific category are also trying to expand into different categories, examples being EHR vendors who are building out advanced analytics and digital capabilities. All incumbents face threats from emerging non-traditional sources of competition: Amazon, with its blockbuster Amazon Web Services (AWS) business, is reportedly considering an entry into the pharmaceuticals distribution space, while Apple is getting deeper into digital health space, leveraging its vast consumer base of iPhone and Apple Watch users. Large healthcare enterprises, such as UPMC and Quest Diagnostics, are getting into the technology solutions space, either by leveraging proprietary data or by investing in startups through innovation programs. Health plan major Cigna’s recent acquisition of digital health firm Brighter is an example of the lines blurring between technology providers and enterprises.

All of these activities are increasing the range of choices for healthcare providers and consumers alike. However, adoption rates for technology solutions have been well short of expectations. A study by IQVIA, formerly QuintilesIMS, indicates that while the number of mobile health apps has more than doubled in the fast few years to over 318,000, nearly half the downloads are accounted for by a mere 41 apps. In this environment, we can be sure of only one thing: Hypercompetition in the technology vendor space as solutions vie with each other to gain attention.

The great EHR implementation sweepstakes have come to an end, with a handful of clear winners, as we look at the near-total penetration of EHR systems in the healthcare landscape. The title of my book, “The Big Unlock,” refers to the emerging opportunity to unlock insights from the digitized patient health records to create value through personalized medicine for improved healthcare delivery, reduced costs and enhanced patient experiences.

The winners in the new sweepstakes are not clear. However, a few characteristics will define the eventual winners – use of advanced technologies, such as artificial intelligence (AI), the ability to integrate and analyze vast amounts of data from diverse sources in real time, and the development of seamless digital health experiences that are intuitive for consumers while not being onerous for healthcare providers.

Significant structural changes will disrupt the healthcare market, driven by ongoing consolidation among providers (such as Catholic Health Initiatives and Dignity Health), unusual M&A activity (such as CVS Health and Aetna), and the arrival of at least one major new non-traditional player such as Amazon. The disruptions will lead to heightened urgency among technology providers to solidify their market footprint and be first to market with new solutions. The biggest disruptions could be from the fallout on healthcare entitlements such as Medicare and Medicaid arising from the newly passed tax reform bill.

One thing is for sure: 2018 won’t be a dull year for healthcare IT.