May 4

2016

Aligning the Patient Financial Experience to Retail Best Practices

Guest post by Laurie Hurwitz, executive director revenue cycle, Gundersen Health System.

Research indicates that happy patients are also patients who pay their bills; in fact, research from Conance suggests that they are twice as likely to pay their bills in full versus their less satisfied counterparts. In the age of rising deductibles and patient responsibility, this statistic underscores the importance of patient satisfaction. Healthcare CEO’s are feeling the pressure; in a recent ACHE study, patient satisfaction was a top 5 concern for this group of healthcare leaders. Patient financial experience is an area of focus as it links directly to satisfaction and loyalty.

Though providers are motivated to improve satisfaction, real-life application is another issue. Influenced by best practices in retail, travel and other verticals, consumer expectations and a provider’s patient financial experience are typically quite different. Providers who have mitigated this mismatch have been able to achieve above-average results for patient satisfaction, payments and even staff utilization.

At Gundersen Health System, we have used the patient financial experience as a winning differentiator across our five-hospital integrated health network and more than one million encounters across Wisconsin, Iowa and Minnesota. I tend to be conservative in execution of my duties as executive director of revenue cycle at Gundersen, but I also knew that some major shifts would be necessary to align our patient financial experience to patient expectations. We believed that optimizing post-service billing engagement would improve patient satisfaction which in turn would improve our rate of collections.

We felt passionately that hospitals oftentimes create a vicious cycle of poor bill payment experiences with their patients. If only half as many patients paid their bills in full because they did not understand their statements, and if patients were half as likely to return for service if they weren’t satisfied with their billing experience, we were losing revenues and market share due to a totally preventable problem. Happier patients are more likely to pay; as such we needed to ensure that our patients were happy with our billing experience. As a result and in partnership with Simplee, we took inventory of best practices in bill pay and payments cross-industry and explored how to bring these best-in-class experiences to Gundersen’s patient financial experience.

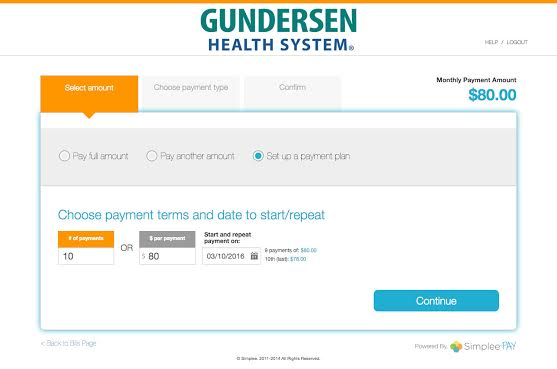

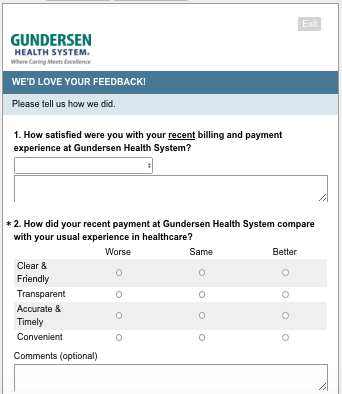

It was obvious that retail payment experiences are designed to make the payment easy, a fundamental difference from health care. Retail facilitates secure guest payment experiences, which eliminated login hurdles. Bills are clear and avoid technical speak, which is practically the antithesis of a typical healthcare experience. Installment plans are flexible and self-service made it incredibly easy for users to stay committed to a payment plan. Retailers also wisely survey clients almost immediately post-transaction, mitigating issues like survey response bias and transaction-survey match confusion.

Self-service Payment Plan Option, Image source: Simplee

Once we formed a picture of an ideal payment experience, it was time to implement. I organized a steering committee to work with Simplee, our patient financial experience vendor, to ensure a flawless implementation. The team included Gundersen’s IT and revenue cycle teams and external vendor, Epic. By aligning stakeholders early, we were able to rollout the new Patient Financial Experience across 36 locations in less than five months.

Post-payment Survey, Image Credit: Simplee

The strategy paid off; more than 20 percent of patients responded to satisfaction surveys. For the purposes of context, this was several times the nationwide average for HCAHPS survey responses. The team was able to use this feedback to improve patient processes, achieve a high patient satisfaction score and earn an above average rate of payment across the board. As a result, Gundersen scored a 78 percent patient satisfaction rating for their billing experience.

And just as we predicted, happy patients translated into a positive financial impact for Gundersen. Gundersen was able to reduce their call volume by 50 percent, which allowed us to move 24 FTEs from taking phone calls to financial counseling, benefit verification, pre-auths, and other higher impact processes. Finally, average collections, increased.

This is just one example of many where providers won by aligning patient expectations to the provider payment experience. There is no doubt that this trend will enable new norms in the patient financial experience that will benefit patients and providers alike.